tax shield formula for depreciation

The tax shield Johnson Industries Inc. Will receive as a result of a reduction in its income would equal 25000 multiplied by 37 or 9250.

Tax Shield Formula Step By Step Calculation With Examples

The effect of a tax shield can be determined using a formula.

. Depreciation Tax Shield Sum of Depreciation expense Tax rate. Depreciation tax shield formula. This is usually the deduction multiplied by the tax rate.

A tax shield is the reduction in income taxes that results from taking an allowable deduction from taxable income. Operating Profit Profit Depreciation Depreciation Tax Shield. For instance if the tax rate is 210 and the company has 1m of interest expense the tax shield value of the interest expense is 210k 210 x 1m.

There are two simple steps to calculate the Depreciation Tax Shield of a company or individual. Companies using accelerated depreciation methods higher depreciation in initial years are able to save more taxes due to higher value of tax shield. Depreciation Tax Shield Formula Depreciation tax shield Tax Rate x Depreciation Expense You are free to use this image on your website templates etc Please provide us with an attribution link How to Provide Attribution.

All you need to do is multiply depreciation expense for tax purposes not financial purposes and multiply by the effective income tax rate. Cash outflow in year 2 12063 30000 333 35 30000 12063 3000 10 35. The tax shield formula is simple.

To arrive at this number you can simply use the tax shield formula where you would multiply the depreciation amount of 10000 by the tax rate of 35 which would give you 3500. This is usually the deduction multiplied by the tax rate. Operating Profit 620000.

Once these numbers are found you multiply depreciation by the income tax rate. Click to see full answer. The result equals the depreciation tax shield as the company will pay lower taxes.

Conversely the lower your depreciation expense the lower your tax shield. When the Depreciation Tax Shield is Most Effective. The amount by which depreciation shields the taxpayer from income taxes is the applicable tax rate multiplied by the amount of depreciation.

This is equivalent to the 800000 interest expense multiplied by 35. Depreciation Tax Shield Formula Depreciation expense Tax rate. Tax Shield Value of Tax-Deductible Expense x Tax Rate.

This gives you 750 in. Depreciation Tax Shield Depreciation Applicable Tax Rate. To learn more launch our free accounting and finance courses Free Courses.

Operating Profit 700000 100000 20000. In short the Net Present Value of the Depreciation Tax Shield is 5 lower with the Sum-of-Years-Digits approach. Cash Outflow in Year 1 Annual repayment Depreciation tax shield Interest tax shield.

The higher your depreciation expense the higher your tax shield. For more resources check out our business templates library to download numerous free Excel modeling PowerPoint presentation and Word document templates. The use of a depreciation tax shield is most applicable in asset-intensive industries where there are large amounts of fixed assets that can be depreciated.

The value of a tax shield can be calculated as the total amount of the taxable interest expense multiplied by the tax rate. Calculating the tax shield can be simplified by using this formula. The intuition here is that the company has an 800000 reduction in taxable income since the interest expense is deductible.

Depreciation Tax Shield Formula. This companys tax savings is equivalent to the interest payment multiplied by the tax rate. Lets imagine that the entire Business is worth 1000 Enterprise Value before the Tax Shield.

12063 30000 333 35 30000 10 35 7513. The result equals the depreciation tax shield as. The maximum depreciation expense it can write off this year is 25000.

Similarly you may ask how does debt provide a tax shield. Multiply your tax rate by the deductible expense to calculate the size of your tax shield. Therefore the company can achieve a tax shield of 20000 by leveraging its depreciation expenses.

Operating Profit is calculated as. The calculation of depreciation tax shield can be obtained by depreciation expense and tax rate as shown below. Interest Tax Shield Example.

Depreciation Tax Shield 20000. The effect of a tax shield can be determined using a formula. For example suppose you can depreciate the 30000 backhoe by 1500 a year for 20 years.

Depreciation Tax Shield 100000 20. The applicable tax rate is 37. So the Business could be worth 5 more or less depending on the approach it chooses.

Tax rate 40 The first two columns of Taxable income with Depreciation. Tax Shield Sum of Tax-Deductible Expenses Tax rate. Depreciation Tax Shield is calculated as.

The formula for calculating a depreciation tax shield is easy. As such the shield is 8000000 x 10 x 35 280000. It also has an option to write off only a minimum amount of 2700.

You calculate depreciation tax shield by taking 100000 X 20 20000. Depreciation tax shield Depreciation expense x tax rate. Thus a tax shield is an amount by which the depreciation and amortization or any non-cash charge lower your income subject to taxation creating cash savings.

Applicable tax rate is 21 and the amount of depreciation that can be deducted is 100000 then the depreciation tax shield is 21000. It is important to have the depreciation numbers along with the income tax rate of the entity being calculated. Interest Tax Shield Interest Expense Tax Rate.

Google company has an annual depreciation of 10000 and the rate of tax is set at 20 the tax savings for the period is 2000. For example because interest on debt is a tax-deductible expense taking on debt creates a tax. Tax Shield Deduction x Tax Rate.

For example Below we have two segments. Depreciation tax shield sum of depreciation expense tax rate. Tax Shield Deduction x Tax Rate.

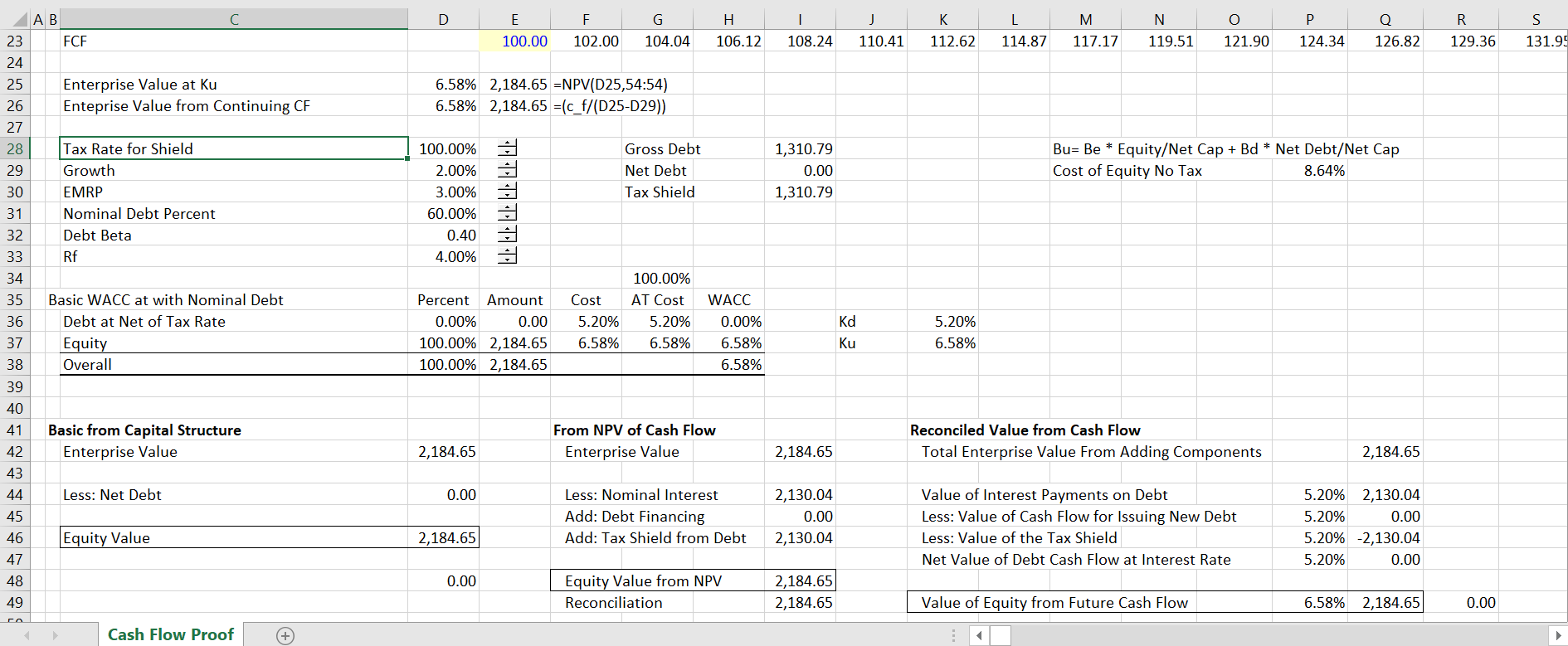

Resolution Of Tax Shield On Interest Expense In Wacc Edward Bodmer Project And Corporate Finance

Income Taxes In Capital Budgeting Decisions Chapter Ppt Download

Tax Shield Formula How To Calculate Tax Shield With Example

Tax Shield Formula Step By Step Calculation With Examples

Tax Shield Formula Step By Step Calculation With Examples

Interest Tax Shield Formula And Excel Calculator

What Is A Depreciation Tax Shield Universal Cpa Review

Depreciation Tax Shield Calculator Calculator Academy

Present Value Of Tax Shield On Cca Evaluation And Computations In Corporate Finance Lecture Slides Docsity

Tax Shields Financial Expenses And Losses Carried Forward

What Is A Tax Shield Depreciation Tax Shield Youtube

Tax Shield Formula How To Calculate Tax Shield With Example

Tax Shield Formula Step By Step Calculation With Examples

Tax Shield Meaning Importance Calculation And More

Interest Tax Shield Formula And Excel Calculator

Cash Flow After Deprecition And Tax 2 Depreciation Tax Shield Youtube

Resolution Of Tax Shield On Interest Expense In Wacc Edward Bodmer Project And Corporate Finance